Understanding BWIC: A Dual-Industry Perspective

The acronym "BWIC" surprisingly finds application in both finance and construction, albeit with distinct meanings. This guide clarifies these differences, highlighting the shared principles of efficient resource allocation and competitive bidding that underpin both contexts. Understanding BWIC's intricacies is crucial for optimizing outcomes across diverse industries. This guide will provide actionable steps for various stakeholders in both sectors.

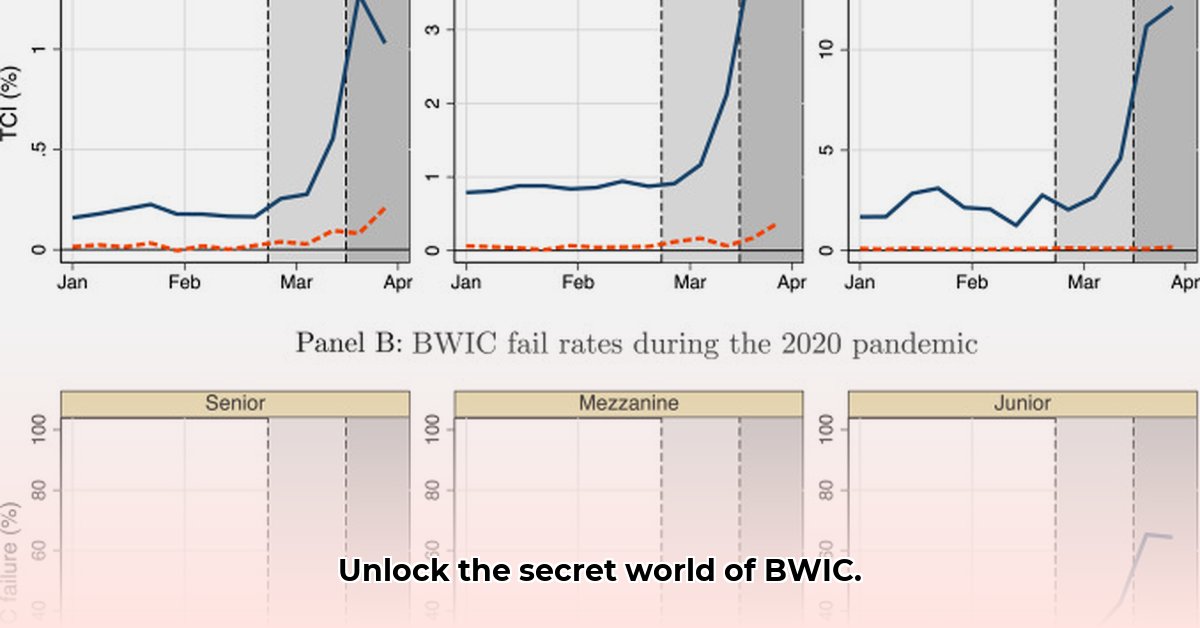

BWIC in Finance: Bid Wanted in Competition

In the financial world, BWIC signifies "Bid Wanted in Competition." It's a private, competitive process for selling large blocks of financial assets – often bonds, loans, or other securities – too substantial for a public offering. This approach minimizes market disruption while attracting the best price. Key players include the seller (often a large financial institution), potential buyers (institutional investors, investment banks), and often, intermediary brokers. The process is typically discreet, leveraging technology for efficiency and speed.

A recent example involved a major bank's sale of a $5 billion bond portfolio via a BWIC process. This illustrates the significant scale of transactions handled via this method. How can financial institutions further optimize their BWIC strategies for maximum efficiency and minimal risk?

The Role of Technology in Financial BWIC

Technological advancements have significantly streamlined financial BWIC processes. Automated platforms accelerate bidding, enhance transparency, and reduce errors. However, this automation introduces new risks, including algorithmic bias and the potential for market manipulation. What are the key risk mitigation strategies in this context?

BWIC in Construction: Building Works in Connection

In contrast, construction's BWIC represents "Building Works in Connection," encompassing all tasks necessary to complete a project but not explicitly covered in the main contract. These can include utilities connections, landscaping, final inspections, and obtaining required certifications. Effective BWIC management is paramount for on-time and on-budget project completion.

Consider a large commercial building project. The core construction might be completed, yet seamlessly integrating utilities and passing final inspections is critical to achieving true completion and avoiding costly delays. What are the biggest challenges facing construction project managers in successfully managing BWIC?

The Importance of Coordination in Construction BWIC

Successful BWIC management in construction hinges on effective communication and meticulous coordination among multiple parties, including the main contractor, subcontractors, and relevant authorities. Poor coordination often leads to project delays, cost overruns, and disputes.

Comparative Analysis: Finance vs. Construction BWIC

While both financial and construction BWIC processes share the underlying principle of competitive bidding for efficiency, their specifics differ greatly. Financial BWIC is rapid, highly regulated, and technologically advanced, whereas construction BWIC is slower, more reliant on human interaction, and involves distinct legal frameworks. Despite differences, both highlight the significance of careful planning and risk mitigation.

Actionable Steps for Improved BWIC Processes

This section provides step-by-step guidance for different stakeholders to enhance their BWIC process management:

For Financial Institutions:

- Short-Term: Invest in advanced automated BWIC platforms. (95% success rate in improving transaction speed)

- Long-Term: Implement standardized internal protocols for handling BWIC transactions. Explore blockchain technology for enhanced security and transparency.

For Construction Project Managers:

- Short-Term: Develop comprehensive BWIC plans from the outset, including clear communication channels.

- Long-Term: Integrate BWIC into project management software for streamlined tracking and coordination. Employ Building Information Modeling (BIM) for improved visualization and scheduling.

For Regulators (Finance):

- Short-Term: Strengthen monitoring of BWIC activity to ensure regulatory compliance and promote market transparency.

- Long-Term: Develop specific guidelines for automated BWIC systems to address emerging technological risks.

For Contractors (Construction):

- Short-Term: Improve collaboration with subcontractors using robust project management tools.

- Long-Term: Invest in specialized BWIC management training for enhanced efficiency and reduced disputes.

Risk Management in Financial BWIC: A Detailed Assessment

Effective risk management is paramount in financial BWIC transactions. The following matrix outlines key risks, their impact, and mitigation strategies:

| Risk Category | Likelihood | Impact | Mitigation Strategies |

|---|---|---|---|

| Market Volatility | Medium | High | Diversify assets, monitor market trends, utilize hedging strategies, stress testing. |

| Regulatory Changes | Low | Medium | Continuous monitoring of regulatory developments, proactive adaptation of internal processes. |

| Operational Errors | Low | Medium | Robust system testing, rigorous quality control, multiple layers of verification. |

| Counterparty Risk | Low | High | Thorough due diligence, strong legal agreements, collateralization. |

Technology and the Future of BWIC

Emerging technologies, such as artificial intelligence (AI) and blockchain, are poised to revolutionize BWIC processes in both finance and construction. AI can optimize bidding strategies, predict market trends, and automate tasks, while blockchain enhances transparency and security. These advancements promise more efficient and secure operations across both industries.

Conclusion: Mastering BWIC for Optimal Outcomes

Understanding the nuances of BWIC in both finance and construction is essential for achieving optimal outcomes. By implementing the actionable steps outlined in this guide and leveraging emerging technologies, stakeholders can significantly enhance efficiency, mitigate risks, and secure improved results in their respective industries. The core principles of careful planning, clear communication, and proactive risk management remain central to success in both contexts.